If you are planning to do a big trek or climb, probably on of the first questions you should be asking yourself is what kind of trekking travel insurance should I get?

Trekking or climbing comes with inherent risks and in the event of injury, the potential cost of medical treatment in a foreign country is massive. The point being, you want to have insurance that will leave you feeling fully covered before you depart on your next big adventure.

Finding the best trekking travel insurance is not easy though. Once you start reading the fine print of many common travel insurance providers, you will immediately notice that high-altitude trekking or climbing is not covered or prompts some question marks about what is covered and what is not.

Well, we have taken the hard work and guessing game out of the equation by providing you with honest advice and tips for selecting the best trekking travel insurance that best suits your needs. Let’s jump right in…

Why Choose Trekking Travel Insurance?

Engaging in high-risk activities like trekking and mountaineering means that at some point during a lifetime of big adventures, there will come a point when an injury occurs and you will need to be protected from the exorbitant costs that come with emergency medical attention and helicopter evacuations.

For perspective, getting a helicopter in Pakistan can cost as much as $25,000. The treatment of a broken bone can cost thousands too, especially if you need emergency surgery.

Whether you are looking for Everest Base Camp insurance or insurance for trekking up to 6000m – one thing is for sure, you must have adequate trekking travel insurance.

Best Trekking Insurance Quick Answer: Global Rescue

If you want to just get straight to the point without having to scroll any further, we understand.

Our staff’s top pick for the best trekking insurance: Global Rescue

Being someone who has organized trekking and adventure trips around the world for the last seven years, I can tell you that I have not found a better travel insurance option for trekking activities than Global Rescue.

These guys specialize in helicopter rescue and extraction as well, and in most situations, you can count on them to come through for you with a helicopter evaluation when you need it most.

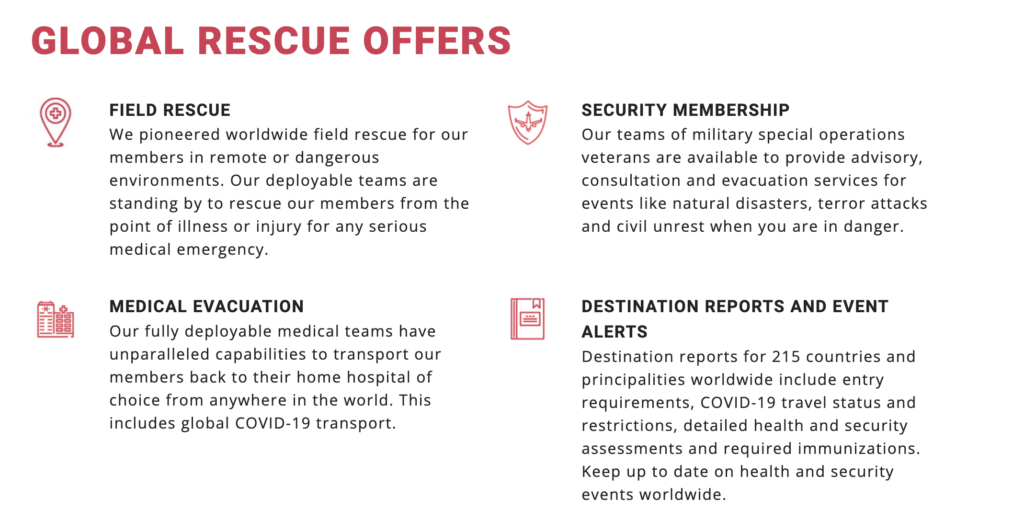

There are two different products that Global Rescue offers and you should understand the difference between both.

Global Rescue Membership: Cover is provided for emergency helicopter evacuations pretty much anywhere in the world. GR pioneered worldwide field rescue for their members in remote or dangerous countries. They literally have deployable teams standing by to rescue their clients in case of a remote illness or injury for any serious medical emergency. It is worth noting that the GR membership only includes the helicopter or emergency evacuation and it not medical insurance.

Here is what is covered with a Global Rescue Membership:

- Global Rescue emergency staff operators on call 24 hours a day, seven days a week.

- No limit on altitude. Even if you are planning on climbing Mount Everest, you will be covered.

- Fast Deployment: If you are injured, the last thing you want to do is need to haggle with insurance companies or to have delays with your helicopter coming.

- Destination reports: for 215 countries and principalities worldwide including entry requirements, COVID-19 travel status and restrictions, detailed health and security assessments and required immunizations.

Global Rescue IMG Signature Travel Insurance: This is the medical insurance part of what Global Rescue offers. The travel insurance is essentially an add-on to the Global Rescue membership outlined above, though it is also possible to get the insurance without having a membership too.

The best part about the Global Rescue travel insurance is that there are no exclusions for trekking-based activities or being at high altitudes; a common exclusion for other travel insurance companies.

The policy also covers things like lost or stolen baggage, search and rescue operations costs, and rental car damage.

The main downside we can find for Global Rescue is that it is expensive – but like most things in life, you get what you pay for and that certainly rings true when it comes to the best trekking travel insurance.

If you are going to climb a mountain higher than 6000m – like Island Peak in Nepal as an example – then this is the right insurance for you.

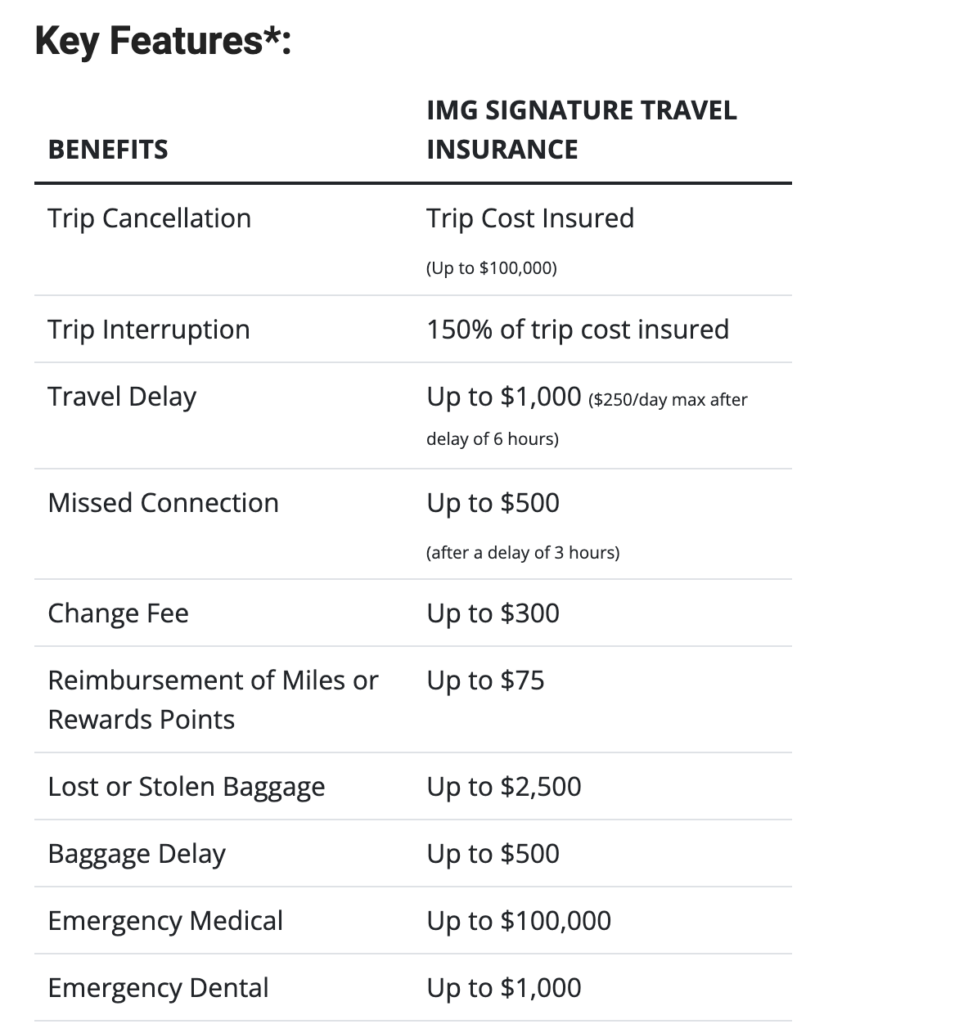

Here are some of the key features of the Global Rescue IMG Signature Travel Insurance:

A Story of First Hand Experience with Global Rescue in Pakistan

There is a first time for everything! The following event proved to be a good test of Global Rescue’s services when the time came to call in an emergency helicopter evacuation. This is how our first experience actually needing to use Global Rescue went down…

Basically, we had one elderly client join us on a trek to K2 Base Camp who was struggling and was sick from a combination of the altitude and something he ate. I made the decision as the trip leader to end his trek on the third day of the trip, more as a preventative measure for something worse happening in the future at an even higher altitude. The client agreed with my judgment call and we called Global Rescue from the satellite phone. They were extremely helpful and responsive.

They arranged for a helicopter to meet us at our camp the next day. Right on time, the helicopter showed up 45 minutes before it was supposed to and the client was air-lifted to a hospital in Skardu for treatment of his stomach bug.

Organizing heli rescues in Pakistan is much more complicated than in Nepal or other adventure destinations around the world because on must go through the army to get the helicopter. Global Rescue handled everything from start to finish and even did wellness checks on the client during the days ahead. After that experience, Global Rescue now has my full confidence as is a major reason why we recommend them to all of our clients.

For the best high altitude trekking travel insurance, Global Rescue seems ticks most of the boxes in our book – and it is fair to say that our clients feel the same way.

Runner Up for the Best Trekking Travel Insurance: Garmin SAR Travel Insurance

That’s right! The company known for making beautiful fitness tracking and altimeter watches and GPS devices now offers search and rescue travel insurance.

It should be clear that the Garmin SAR (search and rescue) does NOT cover any medical costs, so you would need to book additional travel insurance, to cover medical stuff and you need a compatible Garmin device to use it.

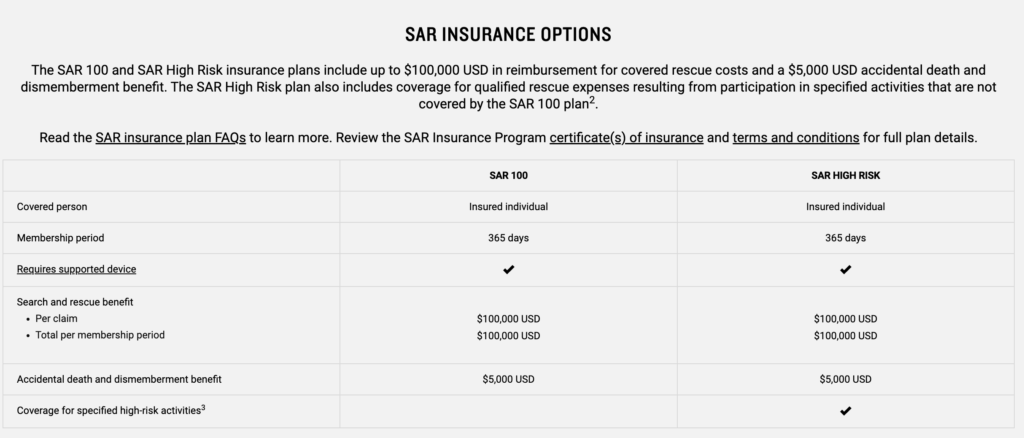

The main function of Garmin SAR insurance is that it covers evacuation and search and rescue incidents. There are two insurance categories to know about: SAR 100 insurance and SAR High-Risk insurance.

The SAR 100 insurance has an exclusion if you plan on mountain climbing – (with intent to go above 5,000M) – so you will need to step up the coverage to the high-risk plan if you know your itinerary has you going above 500 meters – and there is a significant price increase too for the high-risk coverage.

Depending on the length and duration of your trip, the Garmin SAR High Risk policy is one of the best travel insurance for trekking up to 6000m from a costs standpoint.

Both Garmin SAR policies cover up to 100,000 for search and rescue/helicopter evacuation situations.

Here are some of the key features of the Garmin SAR Trekking Travel Insurance:

To use this insurance, you need the Garmin In-Reach or Garmin In-Reach Mini. We have used these devices extensively on Epic Expeditions trips and they function pretty much anywhere in the world including in the middle of the ocean or Antartica.

The story of the helicopter evacuation I mentioned above was mostly done through messages I exchanged with Global Rescue via a Garmin In-Reach Mini before we broke out the sat-phone.

The Garmin satellite messenger devices also have an SMS button that immediately triggers emergency response communications directly with Garmin.

World Nomads has been an industry leader for basic travel insurance for a long time. I have used World Nomads for many of my solo travels in the past. For your standard backpacker’s insurance, they are one of the most popular options and they generally have a good reputation within the backpacker/traveler community.

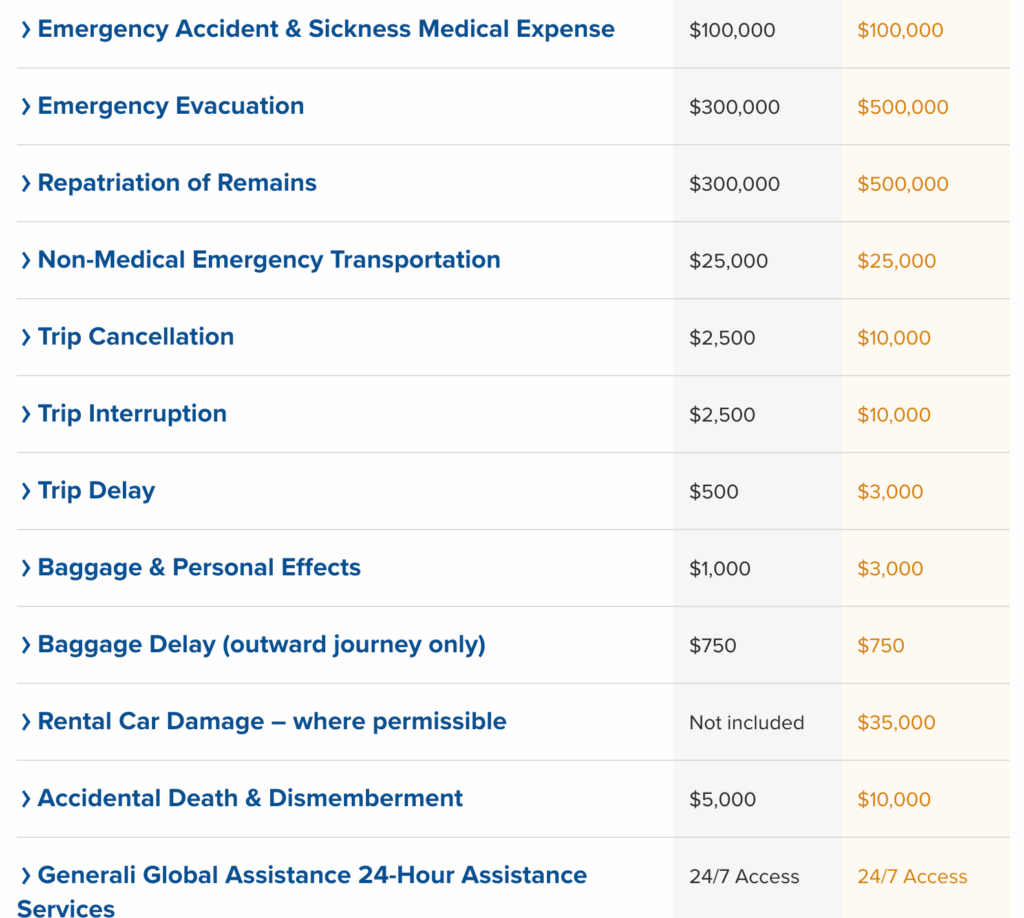

When it comes to trekking travel insurance, World Nomads is a good overall option as they offer medical coverage, rescue services, and coverage for lost or stolen baggage.

The major downside to going with the World Nomads Standard (and cheapest) plan is their lack of coverage due to high-altitude exclusions above 6,000 meters. The World Nomads Explorer policy covers mountaineering expeditions up to 7,000 meters – which is a new feature as of this year.

For the standard policy, if you are using ropes or other climbing equipment, then you might not be covered. As with any insurance, it is best to read the fine print before choosing one based on what your itinerary and plan are.

You can check the different activity coverages between the Standard and Explorers policies here.

Here are some of the key features of the two World Nomads insurance policies (Standard policy coverage is on the left, Explorers coverage is on the right):

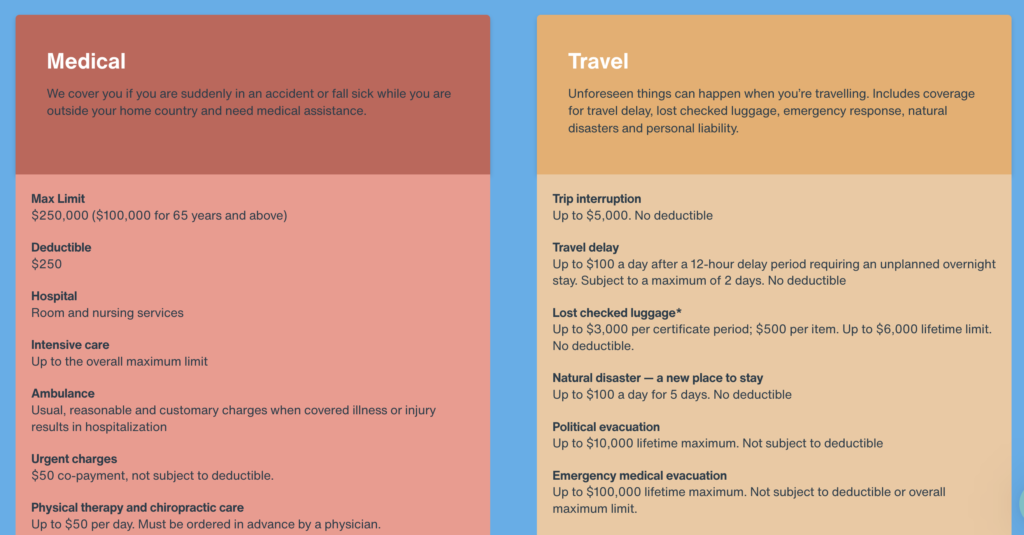

The cheapest travel insurance you will find on this list is offered by Safety Wing,

Safety Wing is known for being “digital nomad” insurance more than adventure sports insurance, but they still do provide some decent coverage. If you are visiting Europe or the USA, going with more basic trekking travel insurance is all you probably need.

If you are trekking or mountaineering at elevations of 4,500 meters or lower then you are fully covered. Their base price is around $42 USD – which is a steal of a deal for basic medical coverage. Note that Safety Wing insurance does not cover helicopter medical evacuation.

Here are some of the key features of the Saftey Wing Nomad insurance policy:

How to Choose the Best High Altitude Trekking Insurance

Choosing the right high-altitude trekking insurance is not a decision that should be taken lightly. There are major financial and safety implications to consider if you choose the wrong insurance for your desired itinerary.

This is why we recommend Global Rescue! From what we have observed, GR comes with no BS – which is exactly what you want in your hour of need.

Here are six things you should consider before pressing the “buy” button for your next trekking travel insurance policy.

- Look at the maximum altitude you plan to reach on your next trip. Travel insurance policies really start to differ when we are talking about 5000 meters or higher.

- Know whether or not you will be using any ropes or climbing tools during your trip.

- Check with the insurance company if coverage is possible for a high-risk destination country with an active war zone, sanctions, or other factors that the insurance company might deem ineligible for coverage.

- See if there is a “cancel for any reason” add-on. Having insurance for trip cancellation is important if you want to protect your investment (ie a trip booking payment) in the case of an unexpected emergency that prevents you from traveling,

- Make sure the travel insurance company you are leaning towards covers your specific nationality for the country you plan on going to. For example, not all insurance companies will cover Americans traveling to Iran.

- Read over ALL of the exclusions and benefits. Understand the policy before you buy it.

The Best Insurance for Everest Base Camp Trek or K2 Base Camp?

Choosing trekking insurance for Everest Base Camp trek or another long-distance high-altitude trek like K2 Base Camp should be pretty straightforward. Since in both cases, you will be going above 5,000m, you should have the appropriate coverage for that altitude.

The K2 Base Camp with the add-on to do Gondogoro La (5600m) might also affect which policy you choose because the descent of the mountain pass known as Gondogoro La involves using a fixed rope line, crampons, and the like.

From our list above, the best insurance for Everest Base Camp trek or K2 Base Camp that our clients have used has been the Global Rescue travel insurance.

World Nomads would be a close second for total medical and emergency evacuation coverage.

Wrap Up: The Best Trekking Travel Insurance for High-Altitude

There you go, guys! I know reading about trekking insurance is the least fun part about going on a big adventure. That says, if you have learned one thing from this article, then you should now know that having the best trekking insurance for your specific project is very important.

Thinking about insurance is just one of those things we must do to ensure we are protected in a worst-case event sort of scenario.

Once you have your trekking travel insurance sorted, you can start to focus on preparing your fitness and the expedition gear you need for the adventure that lies ahead.

If you have not already, be sure to check out Global Rescue travel insurance for one of the most comprehensive policies out there.

Note: We are not insurance professionals or experts. All we can do is provide advice based on the type of trekking insurance our own clients have used and our own previous experience with using these insurance products. We NEVER recommend insurance products our team members have not used themselves.

To be fully transparent, some of the links provided in this article are affiliate links that provide Epic Expeditions with a small commission at no extra costs to you.